TINA (There Is No Alternative to stocks) is dead. That’s a good thing.

However, there is a lot of angst among investors about both stocks and bonds, so let’s look at how bad it is and how bad it’s not.

HOW BAD IT IS

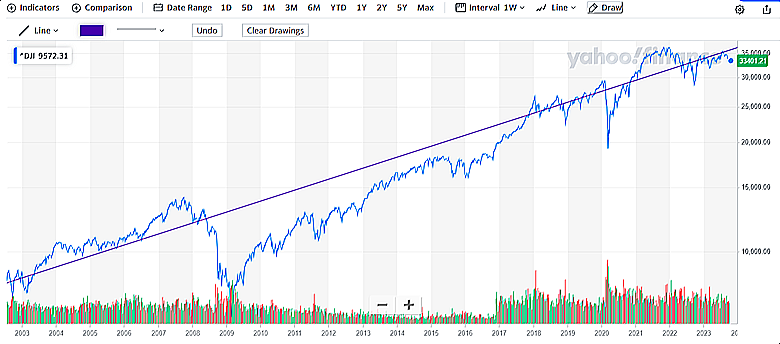

So far this century, stocks have taken investors for a real roller coaster ride.

From 2000 to 2023 the ratio of down to up years was 8:16 or 1 bad year for every 2 good years. That was about normal, going all the way back to 1916. But it included a severe downturn from 2000 to 2003 when the tech bubble burst, a severe financial crisis in 2008 to 2009, a sudden 20%+ one-month drop in 2020 during COVID, and the worst bond market in history in 2022 to 2023, when stocks were also negative for the two years as a whole.

So, while the number of down years was normal, the frequency and severity of the drops was not. Still, stocks returned between 8% to 10% per year on average, depending on the index you use, about 2% below the long-term average.

Bonds were a different story. The average return on the Barclays US Bond Aggregate Index was only 2.3% per year and did not even keep up with inflation. In other words, for over 20 years bonds gave us no real return above inflation and actually slightly trailed it.

words, for over 20 years bonds gave us no real return above inflation and actually slightly trailed it.

Bonds in 2022 to YTD 2023 are going through the worst decline for as long as we have records. Check out this chart on TLT, a proxy for the 20-year Treasury bond, that shows a two-year decline in price of nearly 42% and still dropping. Yes, long maturity bonds can drop over 40% in price, even Treasury bonds. Ask the regional banks that bought them a few years ago. Fortunately, I have had clients almost completely out of bonds for several years and only recently have I started buying again but only individual bonds with short to fairly short maturities.

Now, check out this 24-month chart of the S&P 500 Stock Index (large companies, especially tech) and the Russell 2000 small stock index (red). The red line is much more indicative of the average stock with a two-year price drop of 27%. And nearly all stocks, but especially small stocks, are still dropping in price.

I’ll spare you pictures of the war in Israel and Ukraine, the clown Congress and our embarrassingly feeble president. I’ll also spare you a chart of nearly $100 oil which is at that level despite our president almost completely draining the Strategic Oil Reserve over the last two years trying keep gas prices down. And we’ll not talk about the federal government spending roughly $1.7 trillion more than it is bringing in, all of which must be financed with more federal debt.

HOW BAD ITS NOT

Okay, so that was pretty ugly. Any good news?

First, most clients have a positive return this year despite the downturn in stocks and bonds after holding up well during a very tough 2022.

Second, opportunities in bonds are starting to show up, especially in municipal bonds. You can now easily get 4.5% to 5.0% tax free on maturities from six to ten years. Depending on your tax bracket for state and federal income taxes, that could be worth well more than 6% on a taxable bond. And that is a locked in yield with a fairly close and certain maturity date at which your money is returned.

Closed end funds of municipal bonds are selling at historically wide discounts (as much as -15%) to their net asset value. Some of those funds have a history of selling at a zero discount to which they may very well return over the next few years, giving an extra 15% in gains on top of the income which may be as high as 5% federal tax free. I’m watching some of these for a stop in their decline.

Private credit funds, which I just bought for many clients, are paying 9.5% with adjustable interest rates and collateral to back up the loans.

There are also income-paying funds in alternative investments such as real estate, data centers, and wireless infrastructure such as cell towers, that I expect to return anywhere from 8% to 15% per year. These are not directly tied to stocks or bonds, though interest rate increases may affect their pricing.

Higher paying money market funds are up to 5.4% with little risk.

Last, the stock market does not care so much about far-off wars or political ineptness as people think. I need to often remind people that many headlines that scare people do not scare the stock market.

The stock market really cares about three things – the level of corporate profits, their projected growth, and dividend payments.

Does the war in Israel affect corporate profits? No, unless we’re talking about defense contractors. What about the war in Ukraine? It mainly affects the price of wheat. The price of oil is more tied to OPEC and U.S. production.

Does political ineptness affect corporate profits – only indirectly, because overspending and overborrowing may drive up interest rates, but that is not so much ineptness as a wrong attitude toward debt and that has been a feature of Washington for decades, so while the current spending is higher than normal, it is not new. Stocks went up for many years while we built up the national debt.

Bottom line – there are good opportunities out there aside from stocks, and stocks are a much better deal than two years ago. If the goal for a diversified retirement portfolio is 6-7% per year, there are ways to get that return without stocks. Simply put, there are alternatives. If the goal is simply to stay ahead of inflation, even cash is paying roughly 2% more than the current rate of inflation.

Yes, TINA is dead. To quote Ebenezer Rockwood (often wrongly attributed to Mark Twain), “I didn’t attend the funeral, but I approved of it.”