Let’s look at investing in a presidential election year.

In 2022, the talk was all about inflation and higher interest rates, with many forecasting a recession. In 2023 the talk was about the demise of inflation and the potential for lower interest rates the following year.

2024 Presidential Election

In 2024, the talk will be about the presidential election and there will be more talk, more commercials, and more unwanted texts than just about anyone could want. It is only February and already I am s

As always, the conversation for most will be about what poor choices we have for president, except for those who somehow think Donald Trump is exactly what our country needs. Plenty will disagree with that, but not many are excited about Nikki Haley, and practically no one is enthusiastic about Joe Biden who sometimes comes across as already truly senile.

It would be interesting to see what would happen should Pres. Biden have a stroke or other serious health setback. Maybe nothing, those in Pennsylvania elected someone to the Senate after suffering a stroke so debilitating, he could scarcely communicate. Never underestimate party loyalty in these incredibly divided days. Probably, Gov. Newsome of California would be nominated, and that might be the Democrats’ best hope, though I don’t wish anyone ill, and I pray for our president regularly.

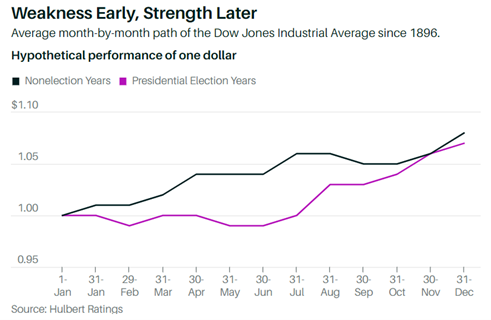

Presidential Year Typical Stock Market Pattern

Source: The Curious Stock Market Pattern in Presidential Election Years – Barron’s

In recent decades, stocks have tended to follow a pretty distinct pattern in presidential election years. The first half often has setbacks and the second half is usually strong enough to catch up to the average annual return by year-end.

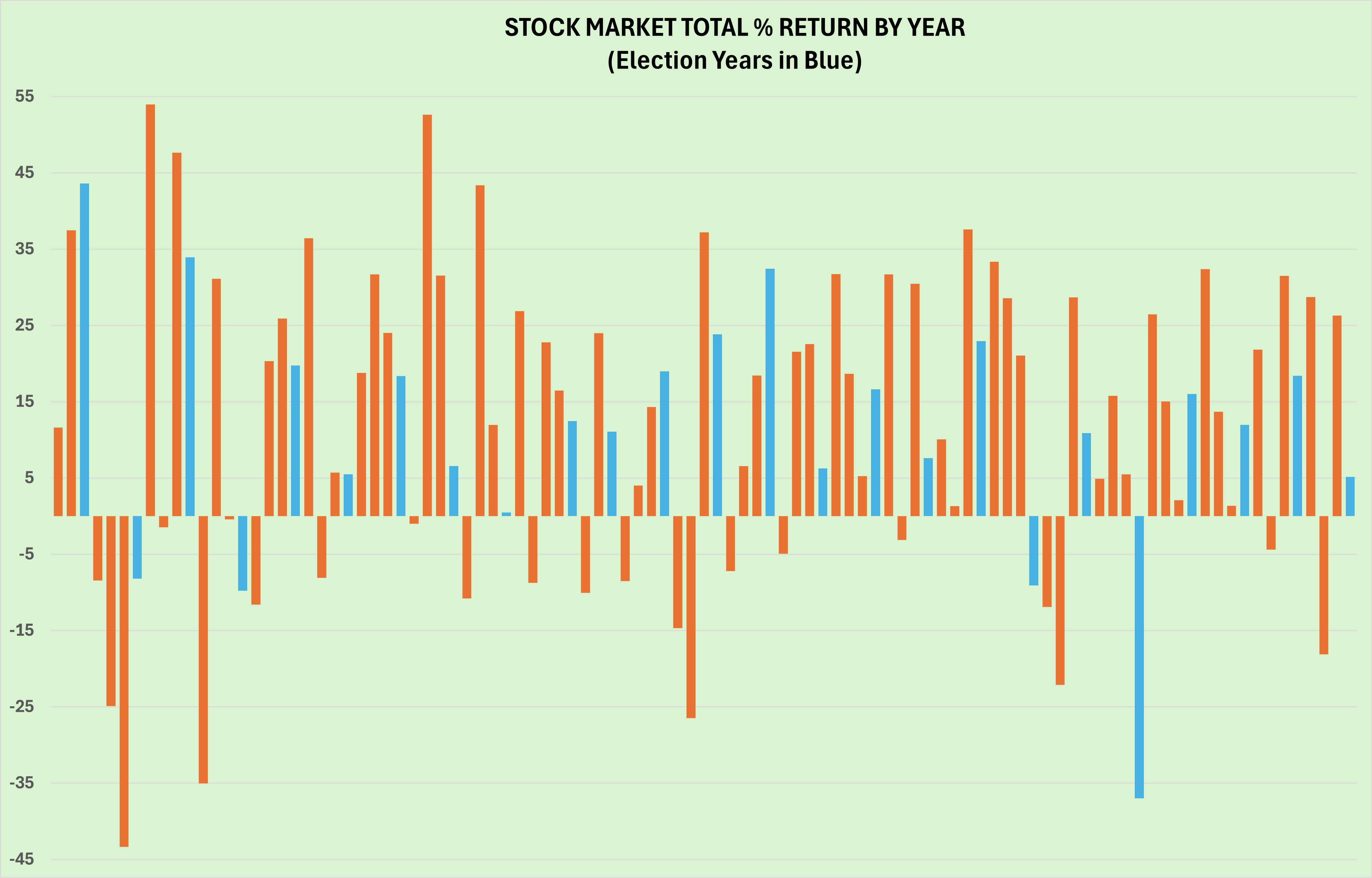

Probabilities of a Down Year

So, what are the probabilities of a down year? Well, since WWII there have been 19 presidential election years and stocks were higher in 17 of the 19 years. The two exceptions were the bursting of the tremendous tech bubble in 2000, which really didn’t get moving south in earnest until 2001 and 2002 and the bursting of the real estate bubble and the near demise of the whole financial system in 2008, two major events that had little or nothing to do with the election that year.

That doesn’t mean this year won’t be down, just that being a presidential per se has not in the past meant trouble for the markets.

What Could Go Wrong? – Trump Felony Lawsuits

For starters, Donald Trump could after such a tremendous parade of lawsuits, find himself convicted of one or more felonies. One could argue

Ex-Pres. Trump faces felony charges in two Dept. of Justice cases, in Georgia, and in New York. Any conviction would be likely appealed and the plaintiffs in these cases know time is against them, but these will be a front-burner issue all year.

There is no Constitutional qualification for president other than being a natural-born citizen over age 35. A felony conviction(s) would not Constitutionally disqualify him, but most likely several states would try to use that to keep him off the ballot and the U.S. Supreme Court would have to step in. It would make for a very messy process – if you thought 2020 was messy, you haven’t seen anything yet. Still, felony convictions might very well dissuade independent voters (those that are left) from voting for him.

What Could Go Wrong? – Other Pitfalls

As mentioned earlier, Pres. Biden’s health could be a deepening issue, but the other thing is that a third-party bid. I don’t see anyone being a serious enough challenger at this point to win any s

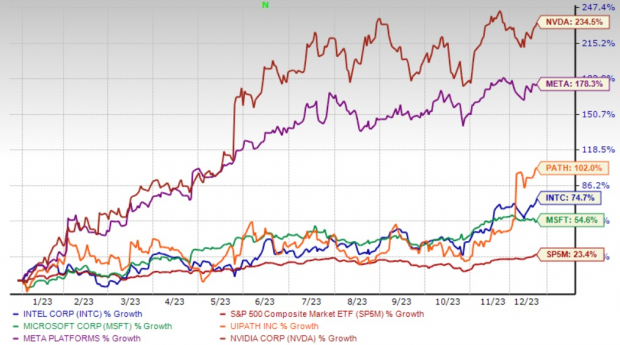

Other potential stock market shocks are health setbacks for either candidate, higher inflation numbers, unexpectedly lower profits, a collapse in AI stock prices, or Chinese military action. Of these, the highest likelihood belongs to a significant fall in high-priced AI stock prices, and while some significant profit-taking seems likely at some point, a collapse like that with highly popular tech stocks in 2022 seems like less than a 50% probability in 2024, though one in the next 2-3 years does seem very likely.

Bottom Line

This year promises to provide plenty of election coverage and heartburn. But past election years have tended to provide average returns, and apart from the two major financial shocks in 2000 and 2008, since WWII election years have not been down years for stocks.

That said, there is plenty of potential for fighting between parties in 2024, an election that involves the U.S. Supreme Court in terms of who can be on the ballot, and perhaps a setback to high-flying AI stocks, all of which could lead to volatility in unsettled markets, but it doesn’t seem like a large drop by year-end is likely. That usually takes more extreme financial conditions. I would recommend sticking to long-term asset allocations and remember that the stock market is mainly a predictor of future profits and not so much an indicator of general unease about other issues.