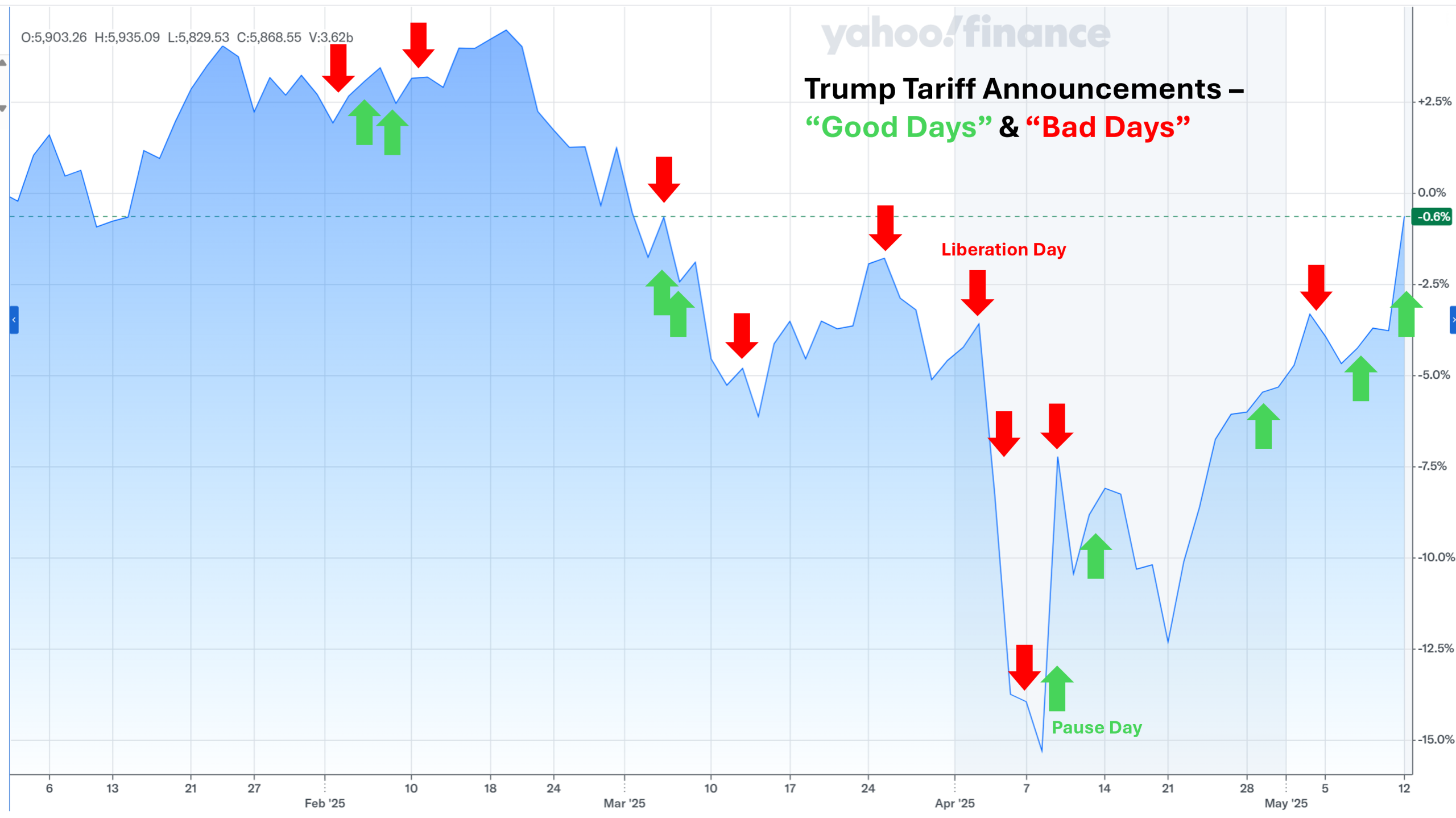

The stock market this year has been fixated on President Trump and his announcements on tariffs. Nothing shows this more plainly than the above chart that demonstrates that stocks have moved almost in lock step with tariff announcements.

That’s because significantly higher tariffs, with a baseline of 10% and negotiated upward or downward from there (the previous average tariff was 2.5%) have the ability to cause significant inflation and lower sales and profits for many U.S. companies. You can argue about fairness when it comes to tariffs, but that is not what the stock and bond markets are looking at. They are looking six months out and trying to gauge the effect on corporate profits and interest rates. So far, their take has been negative, a little less so lately as some pauses and deals have occurred, but still down from their January highs.

This is not to recommend a trading strategy or to encourage short-sightedness, just to make an observation about how the stock market is behaving so far this year.