SHOULD YOU INVEST IN ALTERNATIVE INVESTMENTS?

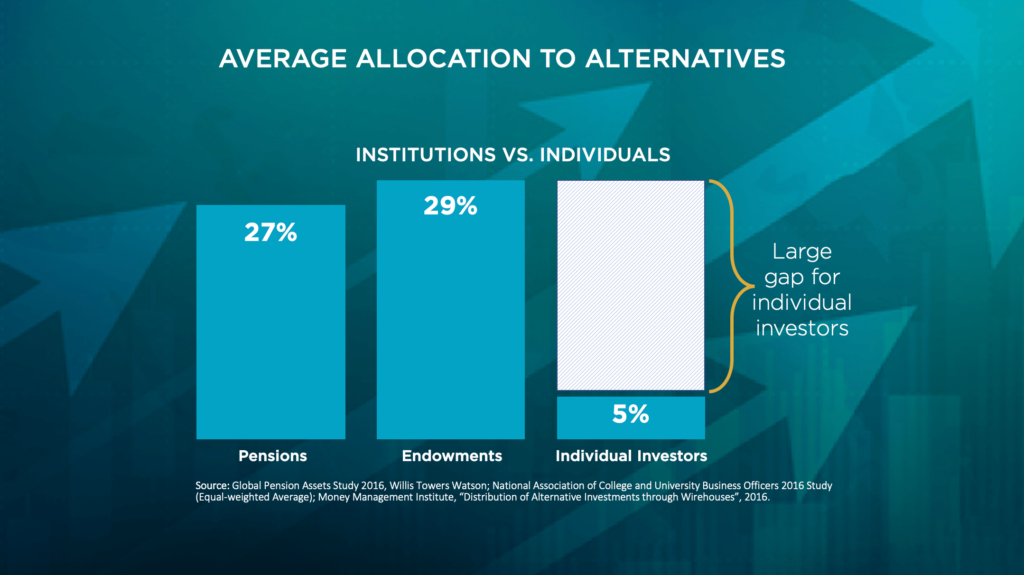

Institutions invest far more in alternative investments than individuals do.

I put investment advisors into three categories with respect to alternative investments (alts).

- No Alts – Some advisors stick strictly to stocks and bonds or vehicles that invest in them like mutual funds, exchange-traded funds, and closed end funds. These are the traditional firms.

- Limited Alts – Others will put 10-20% into alternative investments like private equity, private debt, private REITS, oil and gas partnerships, or other things not usually highly correlated to stocks and bonds in an effort to diversify investments and dampen portfolio volatility.

- Significant Alts – Group 3 might put as much as 30-50% or more into things not related to publicly traded stocks and bonds. I would call this the Yale model of managing money – highly diversified and much less correlated to public markets. They appreciate how the low correlation to stocks and bonds helps make portfolio returns more consistent and large downturns less likely.

The Bad News – many mass market alternatives to stocks have had poor liquidity and poor performance.

- Poor liquidity was for many years a big problem with many alternatives. There has been no good liquid market for selling units and the few marketplaces that exist tend to see units trade hands at very steep discounts to the original purchase price and are not available for custodial accounts like IRAs. Some funds have stretched their lives well beyond what they originally forecast.

- Less than promised performance has been too frequent for alternatives with low minimums for investment. Perhaps markets changed or managers veered from the promised strategy, fees took a toll, there was corruption, or managers got greedy collecting fees and did not initiate a liquidity event in the time promised.

The Good News

- The interval fund format has become much more widespread. This typically provides a redemption opportunity every month or every quarter subject to a cap, typically 5% of shares outstanding except for redemptions due to death. Almost all new alternative investments I see follow this format. This is an improvement, but for poorly performing investments, the caps are a problem, especially if the redemption period is monthly (cap is too low) or semi-annual (cap is too infrequent).

- Better results with private debt – I have seen very good results the last few years with some private debt managers using the interval fund format. It is wise to check what percentage of assets is actually in private vs. public debt. It varies a lot. Increasingly, private debt (non-bank lenders) is replacing bank debt as financing for small and medium businesses.

- Better investments – I have also seen much better business models lately for some other types of alternatives with higher investment requirements and qualifying requirements. These are things like certain types of bridge loans, litigation finance funds, purchasing life insurance settlements, and purchasing minority interests in pro sports teams, among other ideas. Their goal is usually double digit annual returns on a consistent basis no matter what the stock market or bond markets do.

- Better but still restricted availability – These seem to be much better alternatives based on concept and inception to date performance, but the qualifying net worth or income is often restricted to “accredited investors” ($1 million net worth or $300,000 annual income if married) or “qualified investors” ($2 million net worth aside from personal residence).

Bottom line – Alternatives to traditional stocks and bonds have improved significantly in liquidity and only slightly in quality for many clients, but for higher end clients, things seem to have improved more, and alts may be worth significant allocations, depending on the investment and the client profile. Significant due diligence is still prudent.

Note: this is not a solicitation for investing, but strictly informational.