The #1 reason why many retirement plan participants do not contribute as much as they need to have a comfortable retirement is DEBT.

According to a 2023 study cited by Nerd Wallet, here’s the breakdown of what U.S. households owed in total and the average amount per household with each type of debt, as of March 2023 [2]:

|

Type of debt |

Total owed by an average U.S. household with this debt |

Total owed in the U.S. |

Percentage change for total owed between 2021 and 2022 |

|---|---|---|---|

|

Any type of debt* |

$170,182 |

$17.05 trillion |

+7.61% |

|

Credit cards (total)** |

$17,956 |

$1.11 trillion |

+16.99% |

|

Credit cards (revolving) |

$7,876 |

$488.66 billion |

+38.7%*** |

|

Mortgages |

$228,640 |

$12.04 trillion |

+7.73% |

|

Auto loans |

$29,107 |

$1.56 trillion |

+6.33% |

|

Student loans |

$59,461 |

$1.6 trillion |

+0.88% |

|

* This debt can include mortgages, home equity lines of credit, auto loans, credit cards, student loans and other household debt, according to the Federal Reserve Bank of New York. **Total U.S. credit card outstanding debt includes revolving and transacting balances. ***Revolving debt was calculated using the average of the past five years of percentage of credit card debt considered revolving (carried month to month) as opposed to transacting (paid in full each month). In the past, we’ve received these numbers from Experian. The credit bureau declined to provide the revolving vs. transacting data for 2022. |

|||

https://www.nerdwallet.com/article/credit-cards/average-credit-card-debt-household

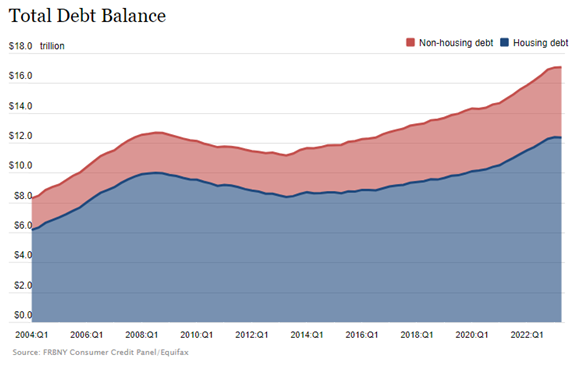

Household debt is increasing as you can see, so the problem is just getting worse. Here’s where I suggest you get a good dose of Dave Ramsey and let him persuade you to get serious about getting out of debt. It’s a real tar baby once you get entangled with it, with interest rates on credit cards making it difficult to make progress. People also finance their homes for too long (30 years) when they should be buying whatever house they can afford to pay off on a 15-year mortgage. Add to that the deadly fascination people have with newer cars and throw in hundreds of dollars a month for one or even two car payments and it’s no wonder there is nothing left for rainy day savings and reducing income to save for retirement seems impossible.

Watch some Dave Ramsey. There are ways out of financial hell but they take extra work, determination, and discipline. But you will thank yourself. If you need help, let me know and I can tell you how our family did it and how you can too.

Also, the Secure Act 2.0 passed in 2022 allows for plan participants, starting in 2024, to have an emergency savings account payroll deduction. That money up to certain limits can be withdrawn without tax or penalty for emergencies like an appliance breakdown, large auto repairs, you name it – the kind of things most households have to charge on a credit card on top of their debt for autos and student loans and mortgage. While there remains important clarifications to be communicated as to how it will work administratively, be sure you talk to your retirement plan advisor about this.