Recently I sent out a client newsletter which pulled prior posts from my new website and which ended up including my market forecast for 2023 made in November 2022. That was a surprise to me, but it provided an opportunity to see how I did in forecasting the market climate for 2023 and setting strategy.

So how did I do?

What I forecast in that November update turned out to be fairly accurate.

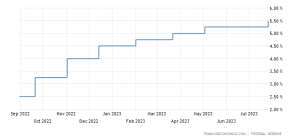

- I said the Fed would need to keep raising rates this year to fight stubborn inflation – They have and will likely do so again in the Fall. In November the rate was at 4.50%. Today it is 5.50%, higher if going up at a slower pace. The increases have had some effect and the Consumer Price Index is down to 3.5% growth from a high of 9% at its peak. It had come down quite a bit by last November but the labor market continues to be tight and wages are increasing at about 4.5%, significantly higher than the 2% Fed target. It will be tough to get that down as far as they would like but the Fed has repeatedly pointed to wage growth as an important concern.

https://tradingeconomics.com/united-states/interest-rate

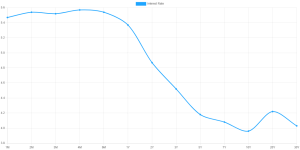

- I said interest rates would go from 3% at that time to 5% or 6% in 2023. In fact the money market is now paying 5% and 6-month T-bills are paying 5.5% with probably a little more to go on both. It might be hard to see on this graph but T-Bill rates are up in the 5.3% – 5.6% range, depending on maturity. This continues the inverted yield curve that commonly accompanies Fed tightening cycles and nearly always triggers recessions. This time may be the exception.

https://www.ustreasuryyieldcurve.com/ - I said we would ease back into the market, starting in November and in fact mid-October 2022 turned out to be the market low. I said we would be conservative and that I did have to change because conservative funds really lagged the market and I switched in the spring to growth-oriented funds.

https://ycharts.com/indicators/sp_500_1_year_return

So, all in all, I think it was a pretty good forecast and we are enjoying a good year in 2023.

Looking ahead, I think you will see the market pull back this fall, starting in August or September but I don’t think it will drop more than 10-15%, a pretty normal correction range. Earnings growth will be minimal for the market overall and growth will command a hefty premium. Rates will likely go up just another 1/4%.

That’s how I see things anyway.