Has 2023 been a good year for stocks? How can you tell?

Well, let’s set 10% as a threshold since that is the long-term average return for stocks. Let’s annualize the returns so far, 10 days from having the first nine months on record and see how we fare.

What shall we use as an index/proxy/benchmark? Well, my last article talked about the extreme effect the largest 7 companies, all tech in some respect, have had in radically skewing the performance of the S&P 500 Index, the one generally used to represent stocks as a whole.

If you recall, the top 7 of 500 companies are weighted so heavily in the index and have soared so high this year that they have accounted for 85-90% of the entire gain for the index. And the thing is, the more they go up, the heavier their weight becomes, so it just gets worse.

The S&P 500 is up 17.13% as of September 20, 2023. However, equally weighting the component companies gives a year-to-date return of just 5.12% That’s the difference between a spectacular year and a below average year.

The other widely followed general index is the Dow Jones Industrial Average (DJIA). That is up 5.83% YTD which puts it very close to the equally weighted S&P 500 Index even though the DJIA is comprised of all very large companies. Annualizing that YTD number gives us a projection of 8.09% for the full year, which would best be described as slightly below average.

That’s disappointing, seeing as how that follows a year in which the DJIA lost -6.36% and the equally weighted S&P 500 lost -11.45%. That’s because years following down years, if they are not down again as a continuation of a bear market, usually have much higher-than-average returns.

For example, after the Dow was down -3.48% in 2018, it returned 25.34% in 2019. The equally weighted S&P 500 gained 29.24% after losing -11.45%. And 2019 was followed by 9.72%/12.83% (DJIA/S&P 500 EW) and then 20.95%/29.63% in 2020. That’s a terrific 3-year run after a relatively modest loss in 2018.

So, maybe after such a great run, another whopper year following 2022’s losses is a bit much to expect.

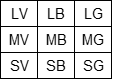

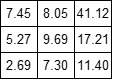

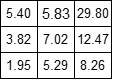

The other way to look at things is with the Morningstar matrix as seen here

Here, size is vertical (large, mid, small) and style (value, blend, growth) is horizontal. So, LV stands for large value. Using the Russell Indexes for all but the top center, which they don’t cover and using the DJIA for that box, we get the following YTD returns (left), or annualized (right).

What this says is that if you were in value stocks, no matter the size you’ve got a very sub-par year. If you were in growth, you had a very good to spectacular year, best if you were in the largest growth stocks. If you were between value and growth you were a bit disappointed, but not as much as the value folks.

This has not been lost on mutual fund managers. Mutual funds typically are beholden to a certain style and size, usually about four adjacent boxes in the matrix. But, since large growth has generally been the hottest part of the market since 2009, many managers, despite their normal styles, have tried to stretch quite a bit and find a way to justify owning large growth stocks, or at least mid-size growth stocks.

For that reason, the median performance for funds with at least 80% stocks has been over 11% YTD, or about 14% annualized. The vast majority of the people holding those funds are happy about that. However, institutional holders who try to build portfolios in certain ways often want fund managers to stick to their size and style mandates may not be happy about “style drift.” But most people are happy about it.

So, bottom line – is it a good year for stocks so far in 2023? If you’re the typical mutual fund holder, yes. If you’ve loaded up on large growth or mid growth, you are very happy. But if you’ve been heavy in value-oriented funds or small company funds, no.

If you are someone buying individual stocks and have not focused on large growth like Amazon, Meta, Google, Apple, Microsoft, Tesla and Nvidia, chances are good you’re disappointed. The lesson is similar to real estate – location matters. Where you are in the style box can make a big difference in return. It has again this year.

.